We all know that dealing with a customer that is late with payment happens all too often. It is a tiresome and time consuming activity that draws you away from the important parts of your home service business. That's why we have created this simple break down of steps to take when dealing with a late payment and when chasing down payments.

1. Set up a tracking system

Another way to prevent late payments as a small business owner and ensure that you get paid in full is to set up an efficient tracking system for invoices and the status of client payments. This can be done with a software program or through a more traditional system you run internally. One of the benefits of using a software system is that you can potentially automate much of your client communication regarding payments. Additionally, many software platforms come with templates for invoices as well as analysis metrics to gauge job profitability. Check out a few popular software options HERE.

- Tip to Try: Don't wait another day to set up an efficient system for tracking payments and communicating with clients, whether that be through software or by hand.

2. Early Action - providing an incentive

The first step to being paid on time is taking proactive action to avoid the problem before it starts. This can be done by sending a reminder in advance of the payment due date in the form of a friendly text or email (see template below). By sending an advance reminder you give your clients much appreciated time to get their finances in order and cultivate a professional brand image. You can even offer a discount for early payment as an incentive to get a customer to pay if you are comfortable offering these payment terms to help cut down on how many follow ups you need to do.

- Tip to Try: Send a reminder text to your customer before payment is due.

Reminder template:

Hello [insert customer name],

Hope you are doing well. Just sending you a reminder for your convenience that the payment amount of [insert amount] for [insert service] is due on the [insert due date]. If you pay by [Insert date] we will offer your next service with a [25% discount] as a sign of good faith for paying on time.

We look forward to doing business with you again soon!

All the best,

[insert your business name] team

3. Pick up the phone - friendly reminder

If the due date for payment has come and gone, it is important to get on top of the situation right away to avoid any potential for miscommunication or further delay. We suggest picking up the phone and giving your customer a polite call to check in on what is causing the delay in payment and create a plan for actionable next steps. If your customer does not answer at first, be persistent and try giving them a call later, as conversations are generally more effective than messages, which can be ignored. It can help if you follow regular schedules to follow up with customers and to have first issued a payment schedule to customers know when they are supposed to pay. You want to build a good relationship with the customer.

- Tip to Try: Give your client a polite call to let them know that the payment due date has passed and assess why they are late with payment.

4. Asses the situation - don't assume the worst with late-paying clients

When touching base with your client about why they are late for payment, it is important to understand the reasoning behind why they might be late and their willingness to make the situation right for your company. Whether they are unwilling to pay, or simply can’t afford to pay at this time will likely necessitate two different paths forward.

It is critical that you don't immediately get frustrated with late-paying customers in the first place as you might not know the reason behind why a customer is late. They could have had a family emergency arise or they simply forgot but do intend to pay you for the overdue payments. At the end of the day you want the customer to pay and have a positive perception of your business either to be a repeta customer or to help leave a positive review or referral.

- Tip to Try: Politely try to understand why your client has been late with payment instead of jumping to conclusions.

5. Work with the customer

As frustrating as it may be, try to keep in mind that it is often better to be paid a bit late than to not be paid at all for your hard work. If you pinpoint that it is a lack of funds that is delaying your payment, then you may want to work out a payment plan with your client. Based on your situation and the relationship you have with your client, you may be able to come up with terms of an agreement that allow them to pay you over a longer span of time in smaller portions. One thing to keep in mind though, is that you most likely do not want to continue to perform work for this client until you have been paid for past services.

- Tip to Try: If your customer is late but willing to pay, try working with them to set up a payment plan.

6. Get legal support

If you deem that it is an unwillingness to pay for your services already rendered that is holding up your payment, you may want to seek legal advice before proceeding to ensure that you are operating in a legally compliant manner and assess your chances of success through small claims court etc. It is important to note that legal support may outweigh the cost of the collection you are seeking so proceed with caution before pursuing this step.

- Tip to Try: If your customer is unwilling to pay for services rendered, it may benefit you to consult a lawyer on steps forward.

7. Check your business practices

If you find that you are repeatedly being paid late, or are spending an excessive amount of time tracking down payments, you may want to consider updating your billing policies. This could include charging a certain payment upfront before services are performed, or requiring cash the same day that services are delivered.

- Tip to Try: If you are being paid late too often, try asking for payment upfront.

A few creative ideas that you can consider

- Offering payment for larger jobs - allowing the customers to pay in pieces for their

- installments

- invoice

- Collecting deposits - for larger jobs you may want to ask for a to prove that the customer intends to pay and is committed to the work

- deposit

- Set up communication automations - from to a contact payment you need to know clearly when a customer is behind on payment and when are approaching

- reminder emails

- timeline

- payment deadlines

- Stop servicing - don't be afraid to drop bad customers in turn to free up capacity for

- chronic late payers

- new customers

- Partner with a collection agency - for large jobs that customers are delayed paying you may need to resort to paying a to help get your full payment and solve cashflow problems

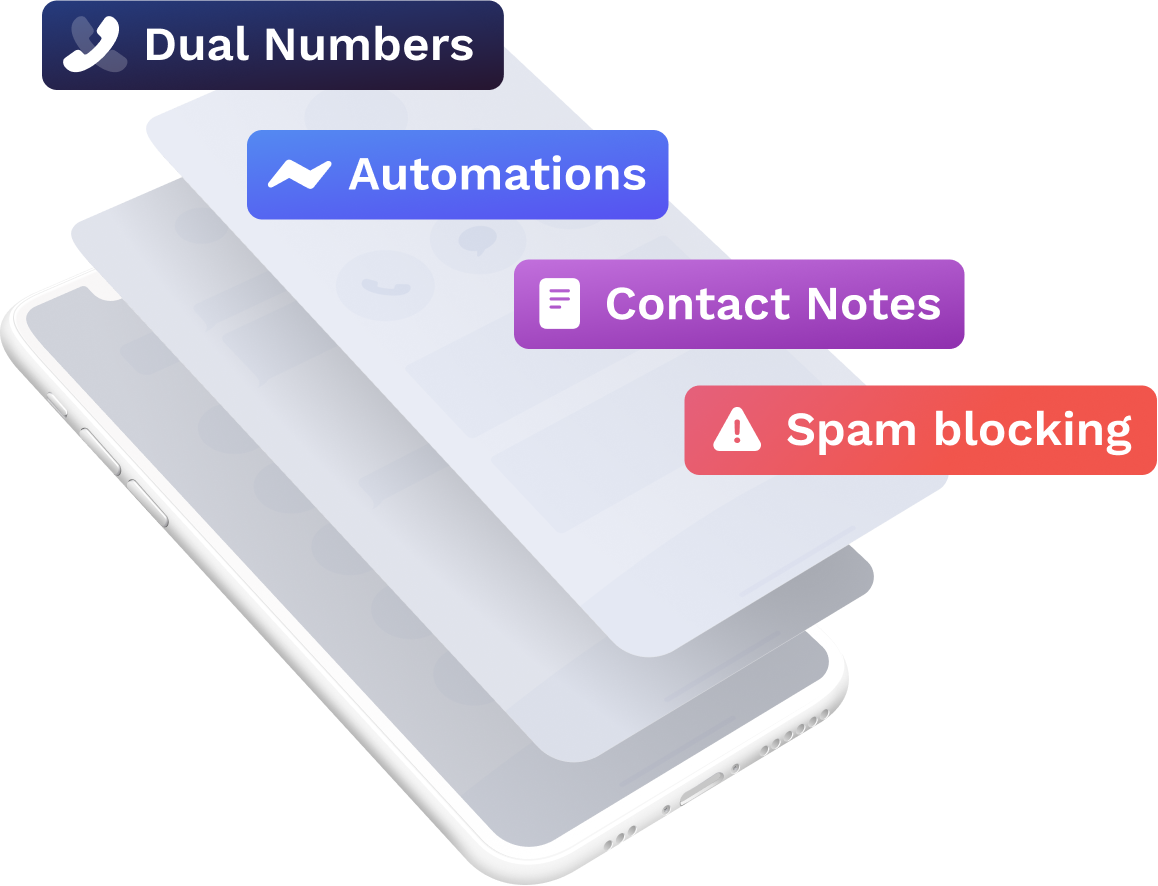

At the core of handling customers that are late with payments is to have efficient customer communications that are not lost track of. It can help to have a dedicated business phone and communications system such that you don't lose track of customers in the mix of personal communications. To help with this check out ProPhhone. The ProPhone app can help you automate some customer communication and keep it separate than your personal line.

.png)

.png)

.png)

.svg)

.png)

.png)

.png)

.png)

.jpeg)

.png)

.png)